SEIS (Seed Enterprise Investment Scheme) is a new government incentive to help UK start-ups and young companies.

SEIS (Seed Enterprise Investment Scheme) is a new government incentive to help UK start-ups and young companies.

It starts in just a few weeks on April 6th, so now is a good time to start building this into your funding plan for your start-up. Or if you are an Investor, have a look to see if this will be applicable to the businesses into which you are investing.

There has been a similar incentive around for some time now (see EIS) but the SEIS is specifically targeting new companies.

The details will come out in the Chancellors budget speech next week (21st March), but these are the basic points:

- The business must be new, or 2 years old or less, with fewer than 25 employees. It must have less than £200,000 of gross assets and not quoted on a stock market.

- Directors or executives cannot use the scheme to invest in their own companies.

- You can raise up to £150,000 of funding through the SEIS, but mustn’t have already raised any money under EIS or venture capital trust (VCT) schemes. This is in total not per year.

An Investor can have up to 30% of a share in the business under this scheme. The SEIS makes it attractive for an Investor to fund a start-up because of the number of tax reliefs that they would receive:

- Investors can claim back income-tax of 50% of the amount invested.

- An Investor can have a ‘capital gains tax holiday’. Capital gains tax (CGT) can be avoided on any asset sold during the financial year 2012-2013 as long as they reinvest the proceeds in a SEIS eligible start-up in the same year.

- The combined effect of the CGT holiday and the income tax break gives relief of up to 78% in the first year.

There is as you can imagine, a number of detail points that would need to be investigated but this should whet your appetite. It’s well worth while finding out more about the scheme either to make your new business attractive, or to maximise your investment returns.

After the chancellor has given final details next week, I’ll do a summary here and point you towards the required forms that the revenue will need to be completed.

Am I the only one that is getting confused by the increasing number of initiatives that the government is rolling out to encourage entrepreneurship? Or frustrated because they don’t actually seem to make a difference?

Am I the only one that is getting confused by the increasing number of initiatives that the government is rolling out to encourage entrepreneurship? Or frustrated because they don’t actually seem to make a difference? “How do I get an Investor?” is the question I most get asked by entrepreneurs. Finding an Investor is often a hard and very time-consuming part of growing a business, but thousands of companies manage to do it every year.

“How do I get an Investor?” is the question I most get asked by entrepreneurs. Finding an Investor is often a hard and very time-consuming part of growing a business, but thousands of companies manage to do it every year. I must admit this blog sounds a bit as though I’m standing on a soap-box, but a recent comment by Google’s chairman, Eric Schmidt, rang true with me. He said:

I must admit this blog sounds a bit as though I’m standing on a soap-box, but a recent comment by Google’s chairman, Eric Schmidt, rang true with me. He said: Whenever I hear advice from successful entrepreneurs the most consistent mantra is “always hire the best people you can afford”.

Whenever I hear advice from successful entrepreneurs the most consistent mantra is “always hire the best people you can afford”.

I went along to The London Funding Conference at the British Library last night and was again impressed by the Library’s ability to host these events.

I went along to The London Funding Conference at the British Library last night and was again impressed by the Library’s ability to host these events.  A few days ago the office of the Prime Minister sent a letter to many small businesses and SME organisations explaining that a new online tool called

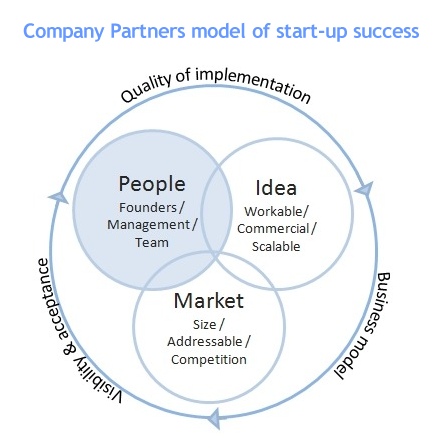

A few days ago the office of the Prime Minister sent a letter to many small businesses and SME organisations explaining that a new online tool called  There’s a common misconception of the typical entrepreneur being a charismatic individual business person, not needing or wanting a partner’s help in driving forward his all conquering venture.

There’s a common misconception of the typical entrepreneur being a charismatic individual business person, not needing or wanting a partner’s help in driving forward his all conquering venture.