I originally put a similar article to this in our resources section, but we continue to get questions about what to do if you have invented a new product, so I’ve also put these 7 tips here in the blog to reach a wider audience.

I originally put a similar article to this in our resources section, but we continue to get questions about what to do if you have invented a new product, so I’ve also put these 7 tips here in the blog to reach a wider audience.

1. Work out whether it is an “invention” or a more of a “good idea”.

The difference is that with a new invention, you can patent it (legally own it and no one else can make it). Whereas a good idea for a product or service may not be patentable, but you believe that you can be first into a market and so don’t want others to latch on to that idea.

The Patent Office does a patent search service that will help you decide if you have a case for raising a paten, they do charge for this however. Company Partners has fact sheets on patents, trademarks and copyright in the Company Partners resources pages, have a look down the resource list to find them.

2. Be careful when you tell anyone about it.

Often inventors are concerned that people may steal their idea. However if it is an invention that may be patentable, if you tell people about it first, not only may they steal the idea, but more importantly from a legal stand point…. you no longer own the idea! This is because it is now in the “public domain”. It can no longer be patented.

What can you do? Before you tell anyone, have them sign a NDA (Non Disclosure Agreement). This is a simple agreement that protects your idea or invention. Here is an example agreement. If it is likely to be a novel and patentable invention don’t tell anyone at all without an NDA. If it is more of a good idea but not patentable, you will have to decide if you want a NDA signed in every case. Some people will happily sign, others won’t.

3. Companies that help you put your idea or invention into production.

If you type “invention” into Google you will get several pages of companies all offering you help. Why? What do they get out of it? Well mostly they will want to sell you their services. It may not be obvious from reading their literature at first, but it starts with you submitting your idea. Then they will suggest that they can give you an assessment of that idea/invention – for a price. Normally a few hundred pounds. This is their bread & butter money.

They may then commit to do more (like find a buyer to license the invention from you) in exchange for a share of the royalties, but with an expenses fee attached. Or they may say that after their evaluation there are things that you can do to improve the chances of it being marketable, or of finding an investor to provide funds. This second stage normally costs a few thousand pounds.

So you can see that you have to be careful who you go with and indeed if you should go with such a company. There is a lot you can do for yourself without paying thousands of pounds. Many Mentors and Investors in Company Partners will contribute their expertise and knowledge in exchange for equity without you paying anything at all. Also try the British Library’s IP & Business Centre, they provide a wealth of information and help, almost all is free.

4. You have a great idea now you want someone to fund it.

Okay you have a great idea. Do you believe that it’s so good that you’ll remortgage your house and spend all your savings (which is what James Dyson did)? Or maybe you need some additional funds beyond that which you have access to?

This is where Angel Investors can help. These are private individuals that are looking for interesting opportunities to invest into. However Business Angels and private investors have seen it all before, most of them will expect you to also contribute some of the finances and put yourself on the line for it to succeed, or they also will not invest.

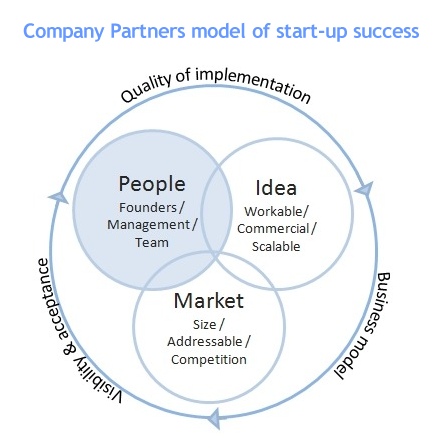

5. Implementation is king (ideas are 10 a penny).

Well some ideas are better than others of course. But everyone has some good idea for a new product or service inside them. It’s those people that get out there and make it happen that are different. 99% of great ideas never get further than a chat down the pub, or wishful thinking.

Then when you do start to make it happen, how well you implement the idea makes the difference to success or failure – not just the idea itself. If you are not best at marketing, sales or even detail planning, look for a business partner.

6. Be realistic.

It may be a great idea, but will people part with their hard earned cash and buy it? Sometimes they are great ideas, but ones that no one would actually pay money for. Be especially wary of “gadget” type inventions. Check that people really would buy them. These sound great, but often too few would be sold to make your fortune.

Do some market research; check whether other similar products or services are selling well. Put together a questionnaire, or a prototype and ask members of the public if they would spend money to buy it (friends and family don’t count). What is the addressable market for this? If it is sold, will it be at a profit (add up all expenditure and costs, including salaries and selling/distribution costs)?

7. Persevere and put in the energy.

If you’ve been realistic and after considering everything, you still want to get this invention or good idea into the market, you have to be persistent. We’ve all heard of the great businesses that were originally turned down by funders.

I listened to Tim Waterstone once describe how he was turned down for a loan to start the book chain by various banks. He persevered, mortgaged himself to the hilt and found an investor. When he was successful and eventually sold for millions to HMV, he sent the banks that turned him down a newspaper cutting of the sale.

He was however a driven and energetic man who didn’t believe in just dreaming. Not all of us are the same, but you do need determination and it helps to have a business partner or mentor. They can give you motivation and together you can bounce ideas around.

Think in business terms and understand that no one is going to give away their time or money unless you can prove the concept is a winner. That will require upfront effort and investment from yourself. But you can’t just dream – you have to make it happen.

I went along to The London Funding Conference at the British Library last night and was again impressed by the Library’s ability to host these events.

I went along to The London Funding Conference at the British Library last night and was again impressed by the Library’s ability to host these events.  There seems to be no end of potential experts telling entrepreneurs the best way of getting their business funded and I guess it’s difficult at times to judge just what the optimum route for investment may be.

There seems to be no end of potential experts telling entrepreneurs the best way of getting their business funded and I guess it’s difficult at times to judge just what the optimum route for investment may be. The first question is should it cost anything? After all it is the Investors who have money, so why should they charge in order to pitch to them?

The first question is should it cost anything? After all it is the Investors who have money, so why should they charge in order to pitch to them?

Business Angels are often thought to be tough and worldly-wise and it’s true that they are people who have made a success of their business life, but even a Business Angel needs to remember to use their head rather than just their heart when making investment choices.

Business Angels are often thought to be tough and worldly-wise and it’s true that they are people who have made a success of their business life, but even a Business Angel needs to remember to use their head rather than just their heart when making investment choices. The EIS (Enterprise Investment Scheme) was set up to encourage Investors, by giving them various tax breaks if they help to fund growing businesses.

The EIS (Enterprise Investment Scheme) was set up to encourage Investors, by giving them various tax breaks if they help to fund growing businesses. I originally put a similar article to this in our resources section, but we continue to get questions about what to do if you have invented a new product, so I’ve also put these 7 tips here in the blog to reach a wider audience.

I originally put a similar article to this in our resources section, but we continue to get questions about what to do if you have invented a new product, so I’ve also put these 7 tips here in the blog to reach a wider audience. Angel Investors are not listed in the Yellow Pages and finding one can be a time consuming and expensive business, especially if using some of the pricey business angel intermediaries that are out there.

Angel Investors are not listed in the Yellow Pages and finding one can be a time consuming and expensive business, especially if using some of the pricey business angel intermediaries that are out there.