Investors look for business growth

Firstly let me say what I mean by scalable. That each new customer produces additional revenue for very little addition cost.

Think of software for example, once the costs of developing and producing the first copy are met, each additional sale of the software has minimal costs. Whereas a service orientated business such as consulting is limited by the number of consultants available and each one has a significant additional cost attached.

A scalable business can grow large and produce high profits, every Investors dream.

If you are starting from scratch and have a choice of the type of business to run, think about fixed cost Vs variable costs for that business. Fixed cost will be that which you need regardless of the number of orders you receive – office or factory rent, insurance and basic salaries for example.

The variable costs are those associated with each order, such as the cost of making that product or supplying the service. It can be materials that you have to buy in for each order, assembling or manufacturing the item, or the cost of hiring and paying the wages of an additional service person to fulfil the order.

There is of course going to be some additional (variable) costs associated even with a scalable business. You’ll need more marketing or sales staff if you are growing and other additional expenses, but it’s not the main cost of each new order.

Tips for a scalable business

- Build it into your business model. Make being scalable an essential part of what you do and how you operate. Don’t undertake activity that can’t be scaled even if it seems like additional revenue, if you are not able to scale it, don’t do it.

- Decide what your core expertise is and outsource the rest as much as possible, that way you are not restricted on growth. You can also form partnerships with others to allow faster growth.

- Automate, automate, automate. Think through the whole sales/supply chain, cheap computing power now days can make business processes for each new order very little additional cost.

- Being scalable by itself is not of use unless you can take advantage of it by getting lots of new business. You will need to market yourself as heavily as you can afford. This is where Investor funds can help (if you have a compelling business model and show you know the market). Use indirect marketing to give scalability to your marketing. PR, news items, Facebook/Twitter and brand recognition all have far reaching effects.

- Use the web. The most obvious scalable companies are web based social media sites, but even if you are a product orientated business you can get very scalable using the internet. Amazon are a product company, but they outsource their products and sell and fulfil using the web.

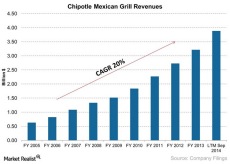

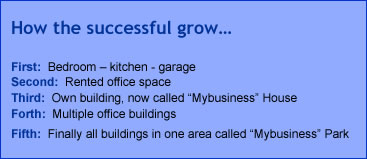

- If the business is not easily transferred to the web, perhaps because it is a very hands-on service, look at franchising or licensing your product or business model. There are all kinds of businesses successful this way from fast food to grass cutting companies. The example chart on this page is for a Mexican restaurant!

Not every business will want Investment, or to grow large and that is fine, but even those can benefit from looking at the way that scalable businesses make life easier for themselves by automating and using the scalability techniques now available.

I talk to a lot of owners of businesses each year who are putting all their time, energy and money into growing their business and have no plans to use any of that hard fought cash to pay into a pension.

I talk to a lot of owners of businesses each year who are putting all their time, energy and money into growing their business and have no plans to use any of that hard fought cash to pay into a pension.

You don’t know when you might bump into or be talking to a useful contact, business partner or even potential Investor. This first conversation is your best chance to impress and could determine whether you get a second more detailed conversation or meeting.

You don’t know when you might bump into or be talking to a useful contact, business partner or even potential Investor. This first conversation is your best chance to impress and could determine whether you get a second more detailed conversation or meeting. 1. Work on your brand and image.

1. Work on your brand and image. Being investment ready is key to getting funding. Yet when talking to entrepreneurs they often have not taken the time to think it through.

Being investment ready is key to getting funding. Yet when talking to entrepreneurs they often have not taken the time to think it through. Many of the people that I’ve talked to recently are individuals, they have a need for funding to start-up or to get greater growth, so they are talking to me about finding investment.

Many of the people that I’ve talked to recently are individuals, they have a need for funding to start-up or to get greater growth, so they are talking to me about finding investment. Whether you’re writing a business plan, or simply want to make sure that your business has customers, you are going to need a sales plan and a marketing plan.

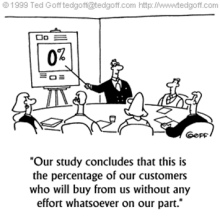

Whether you’re writing a business plan, or simply want to make sure that your business has customers, you are going to need a sales plan and a marketing plan. In a previous work life, I used to give presentations on technology and as a way of lightening the tone of what could be a heavy session, I showed a cartoon. The caption read “In a moment of inspiration Dave the repairman connected the air-conditioner to the Internet”.

In a previous work life, I used to give presentations on technology and as a way of lightening the tone of what could be a heavy session, I showed a cartoon. The caption read “In a moment of inspiration Dave the repairman connected the air-conditioner to the Internet”.